Irs Standard Mileage Rate 2025 For Volunteers. The 2025 medical or moving rate is 21 cents per mile, down from 22 cents per mile last year. 67 cents per mile driven for business use, up 1.5 cents.

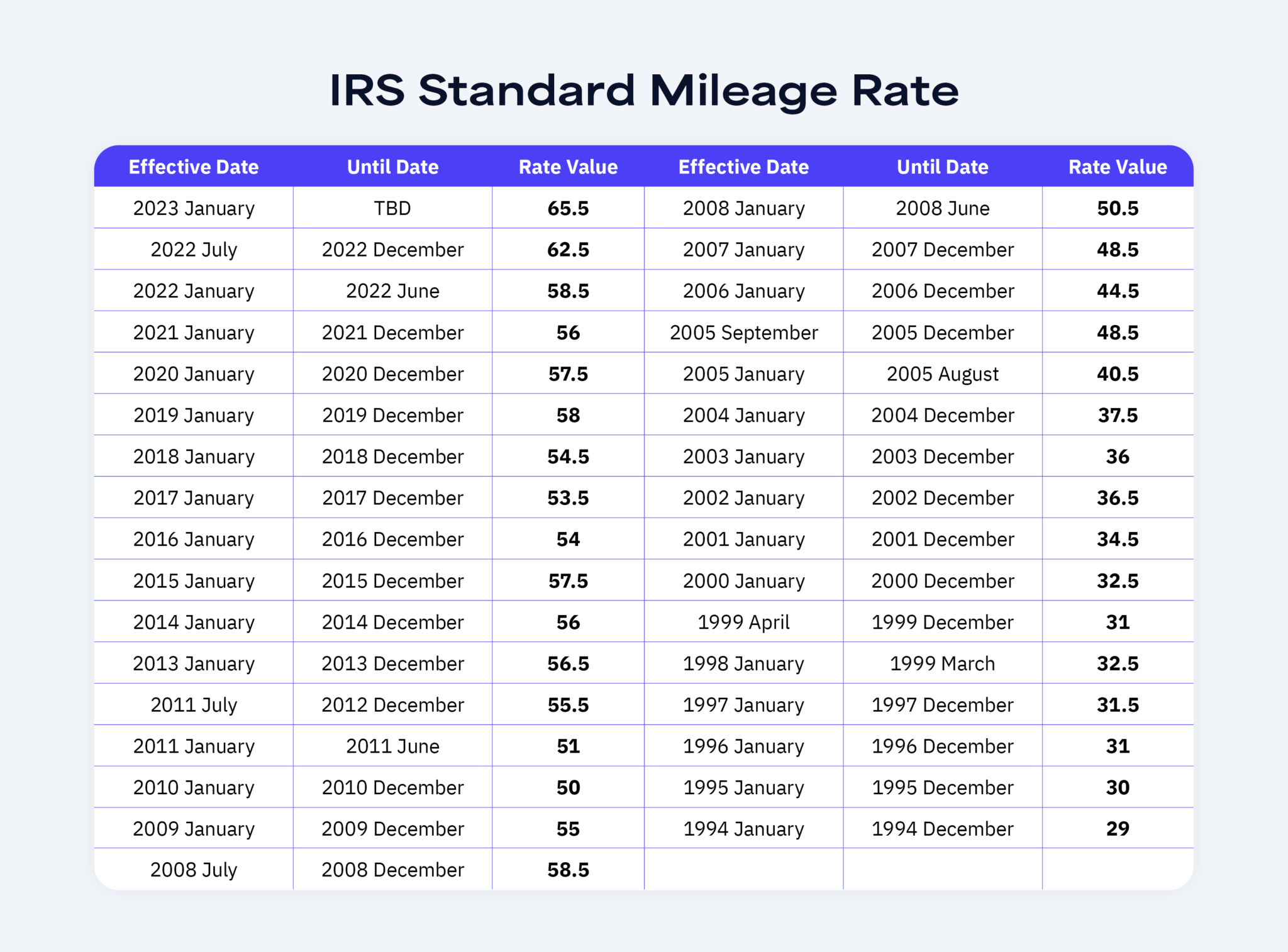

17 rows the standard mileage rates for 2025 are: The internal revenue service (irs) establishes standard mileage rates each year to simplify the process of calculating deductible costs of operating an automobile for various purposes.

Irs Standard Mileage Rate 2025 For Charitable Rubi Wileen, 1, 2025, the standard mileage rate for the use of a car (also vans, pickups or panel trucks) will be:

Mileage Reimbursement 2025 For Volunteers Kally Marinna, It's important for businesses and individuals to stay informed.

Understanding the 2025 IRS Standard Mileage Rates, The irs has released the annual optional standard mileage rates for 2025, encompassing the expenses associated with using your personal vehicle.

2025 Standard Mileage Rates Released by IRS; Mileage Rate Up, Irs standard mileage rates in effect from jan 1, 2025:

/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg)

2025 Irs Mileage Rate For Medical Expenses Cyndi Dorelle, For 2025, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.

IRS Mileage Rates 2025 What Drivers Need to Know, 67 cents per mile driven for business use, up 1.5 cents from 2025.

History Of The IRS Standard Mileage Rate 1994 To 2025 Cardata, For volunteers driving on behalf of charitable organizations, the mileage rate remains unchanged at 14 cents per mile.

.png)

2025 IRS mileage rate gets a boost. Here's the new number, 67 cents per mile driven for business use, up 1.5 cents from 2025.

IRS Mileage Rates 2025 A Comprehensive Guide to Business, Finance, and, 1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: